The Standard and Poor’s 500 (S&P 500) index has been introduced in its current form on 4 March 1957, but it existed previously as well. It has 500 components.

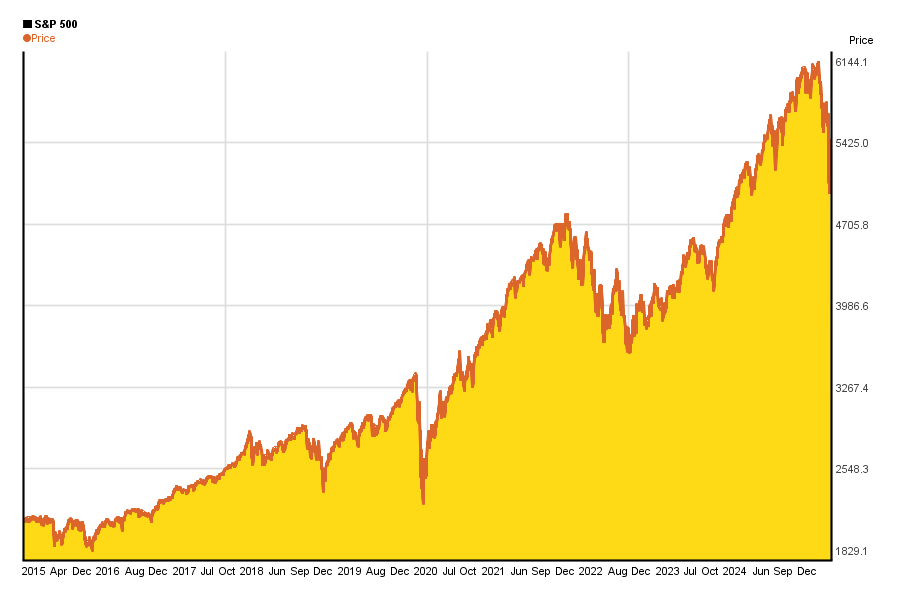

- 10 year S&P 500 index chart

- S&P 500‘s returns in the last 10 years on a chart

- S&P 500‘s returns against inflation in the last 10 years

10 year chart of the S&P 500 stock index*

The 10 year chart of S&P 500 summarizes the chages in the price well, however, we recommend to have a look at the chart(s) below, too.

You can find charts of other periods (1, 3, 6, 12 months etc.) here (updated every day).

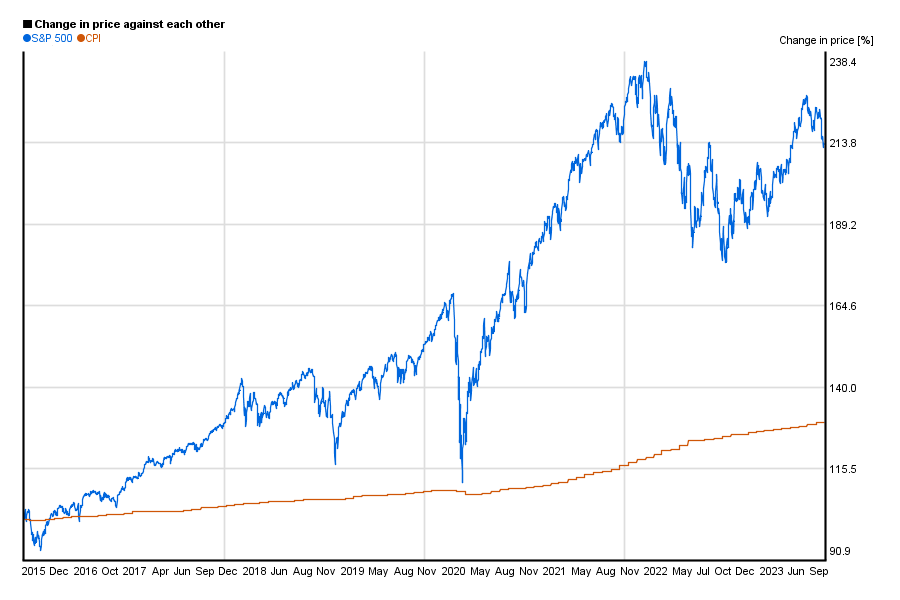

10 years return and graph of S&P 500*

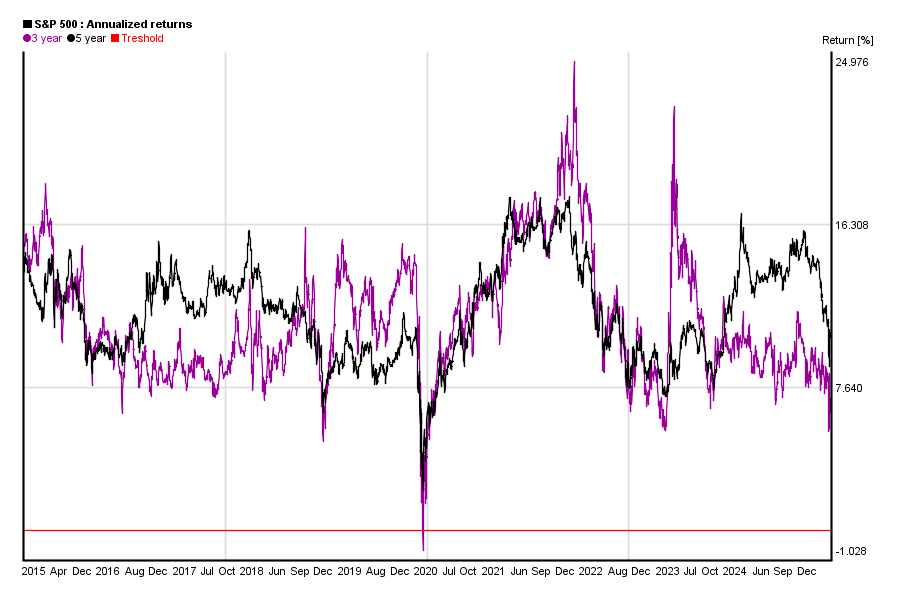

People often say that long term investments carry less risk than short term ones.

Well, on the chart below you can see if that is true for yourself in the case of S&P 500 for the past 10 years.

Similar charts of the past 5 year can be found here.

What can you see on the chart?

You can calculate S&P 500’s 1 month return from S&P 500’s value today and S&P 500’s value 30 days ago. You can also do the same calculation for yesterday and S&P 500’s value 31 days ago etc. If you do this calculation for each days, you will get a curve of S&P 500’s 1 month yield. The same applies to other yield periods from 3 months to 5 years.

This chart shows the three and the five year yield curve in the past 10 years.

Treshold marked with red shows 0% return.

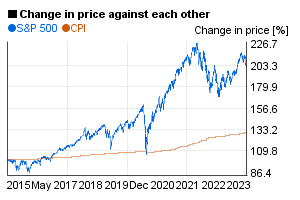

S&P 500’s return vs. inflation in the last 10 years*

Changes of price in case of S&P 500 does not carry too much meaning unless we compare it to something else like Customer Price Index (CPI), or an other index.

So this chart shows S&P 500’s relative change against the US customer price index in the past 10 years.

*charts are updated monthly, and they have been created by using Chartoasis Sesame. If you feel like analyzing S&P 500’s historical price, you can do that for free at www.chartoasis.com/sesame . You will also need to download S&P 500 historical data. This step-by-ste guide will explain you how to do it.